Buying without a financing condition insurance

Discover unconditional bidding: a strategy where buyers submit an offer without being dependent on financing. This demonstrates to the seller that you are serious and can act quickly. However, it also carries risks. That’s why we offer an insurance policy that mitigates these risks. Our insurance covers the expenses if you are unable to secure financing after winning the bid. Contact our experts for more information. Bid without worries!

How does the process work?

Bidding with certainty consists of two phases:

During the bidding process:

– You will receive a certificate with a guaranteed maximum bidding amount.

– You promise the seller that you can purchase and pay for the property without a financing condition.

– A (bank) guarantee is immediately provided to support your bid.

After the bid is accepted:

– The (bank) guarantee is formally issued.

– Your advisor will apply for the mortgage.

– If the mortgage is rejected and you terminate the purchase within 42 days, the guarantee amount will be paid out to the seller.

– You are insured and do not have to repay the guarantee amount.*

– The costs will be 850 euros, which is only paid in case of a successful purchase. (Plus the costs of the regular guarantee issuance)

With bidding with certainty, you are assured of a solid bid and can confidently make an offer without a financing condition.

*The insurance conditions determine the coverage.

During the bidding process:

– You will receive a certificate with a guaranteed maximum bidding amount.

– You promise the seller that you can purchase and pay for the property without a financing condition.

– A (bank) guarantee is immediately provided to support your bid.

After the bid is accepted:

– The (bank) guarantee is formally issued.

– Your advisor will apply for the mortgage.

– If the mortgage is rejected and you terminate the purchase within 42 days, the guarantee amount will be paid out to the seller.

– You are insured and do not have to repay the guarantee amount.*

– The costs will be 850 euros, which is only paid in case of a successful purchase. (Plus the costs of the regular guarantee issuance)

With bidding with certainty, you are assured of a solid bid and can confidently make an offer without a financing condition.

*The insurance conditions determine the coverage.

Do I qualify?

The eligibility criteria for the “bid without reservation” insurance are as follows:

– The property must be an existing or new-build property in the Netherlands, intended for personal residence.

– There is no limit to the purchase price of the property, but the insurance only covers up to €75,000 of the bank guarantee. For example, if you buy a property worth €800,000, the usual risk of bidding without conditions is €80,000. With the insurance, €75,000 of that amount is covered, leaving you with just €5,000 at your own risk.

– Both income from employment and self-employment can be considered during the assessment.

– You must be residing in the Netherlands, Belgium, Germany, the United Kingdom, France, Spain, Austria, Switzerland, Luxembourg, Denmark, Sweden, Norway, or Finland.

– The property must be an existing or new-build property in the Netherlands, intended for personal residence.

– There is no limit to the purchase price of the property, but the insurance only covers up to €75,000 of the bank guarantee. For example, if you buy a property worth €800,000, the usual risk of bidding without conditions is €80,000. With the insurance, €75,000 of that amount is covered, leaving you with just €5,000 at your own risk.

– Both income from employment and self-employment can be considered during the assessment.

– You must be residing in the Netherlands, Belgium, Germany, the United Kingdom, France, Spain, Austria, Switzerland, Luxembourg, Denmark, Sweden, Norway, or Finland.

What are the costs?

The costs for the “bid without financing condition” insurance amount to 850 euros, excluding the costs for the bank guarantee. These costs are only charged in the case of a successful purchase and are paid at the notary’s office. In some cases, it may even be possible to finance the costs, allowing you to avoid paying them immediately.

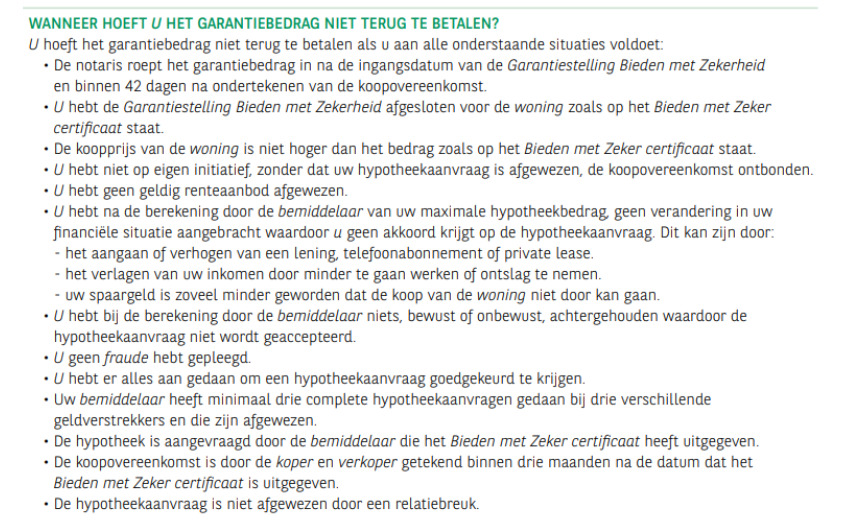

terms and conditions